Do Online Casinos Report Your Winnings to the IRS

You may have a question: “Do online casinos report winnings to the IRS in the USA?” The answer can vary depending on whether you’re playing in a US-based brick-and-mortar casino, a state-licensed online casino, or an offshore casino. Even then, there are thresholds that have to be met. Join us as we explore the topic and answer the question in this article.

What Is the IRS

The IRS (Internal Revenue Service) is the primary tax collection agency in the USA. It helps US citizens and residents to understand any tax responsibilities they have and enforce them. They are friendly enough to help assist you with your taxes, and this includes gambling-related taxes.

The IRS has unsurprisingly effective techniques to hunt down tax dodgers, so it is always best to declare anything you have won.

There are penalties for tax evasion, so most US players get in touch with the IRS to see if they have to pay taxes on anything they’ve won. It is better to enquire about potential tax consequences and set them straight than to be caught out and penalized.

Internet Gambling Taxes Explained

Internet gambling taxes vary from country to country. In the UK, for instance, casinos and providers pay all the taxes; your winnings are yours to keep. Other European countries will tax winnings. It is similar in the US, but there are loopholes and bars that you need to look at. The best gambling sites that are state-licensed often declare whatever you’ve won for you, and some will withhold any taxes you are eligible for. Some do not, though; it is down to you to sort this out yourself.

What Taxes to Pay

Technically, anything you win is fully taxable in the US and should be declared as income on your tax return. These are normally subject to a straightforward 24% tax rate. You have to report gambling winnings on Schedule 1 (Form 1040), and Form W-2G, with the latter specifically related to income earned from gambling that has been withheld by the casino or venue.

Audits Basic Information

If you decide to include your losses (stakes) as a deductible expense when declaring your taxes, then you could be subject to an audit. To make sure this runs smoothly, you need to keep a perfectly clear record of all your stakes and wagers. Without this, you are unlikely to be eligible for a deduction; in the worst-case scenario, you could be accused of trying to defraud the IRS.

Income Tax Requirements for USA Residents & Non-Residents

It isn’t just those residing in the US that have to pay tax on their income. US citizens who are not residents (those living abroad as expats, for instance) should also declare whatever they win to the US authorities. However, non-residents cannot deduct their losses.

There are some grounds for non-residents to be exempt from federal income tax, but this depends on your circumstances and where you reside.

How to Know If Online Casino Gambling Sites Report Your Winnings to the IRS

Back to the main question now: do online casino gambling sites report your winnings to the IRS? If you happen to be playing in a brick-and-mortar US casino, your winnings from games of chance will typically be reported and taxed at 24% according to the following threshold.

| Gambling Game | Winning Amount (And Higher) Subject to Tax |

|---|---|

| Slot Machines | $1,200 |

| Bingo Games | $1,200 |

| Keno | $1,500 |

| Sweepstakes, Pools, Lotteries | $5,000 |

In case of winnings from skill games, Everything is different. Casinos are not obliged to record data on skill games since they aren’t aware of what you started with when you began playing. However, you are expected to declare those winnings via the W-2G form.

When it comes to safe online casinos in the USA, namely state-licensed ones, you should contact support at each casino to see what their procedure is. Offshore casinos certainly don’t declare your winnings, so it is down to you to do this. Unsurprisingly, many US citizens and residents choose not to do so as they aren’t supposed to play at offshore casinos anyway.

How to Pay Taxes

Learning how to pay taxes related to gambling is essential. There are all sorts of guides out there to help you (including on the IRS website); the following is the general information:

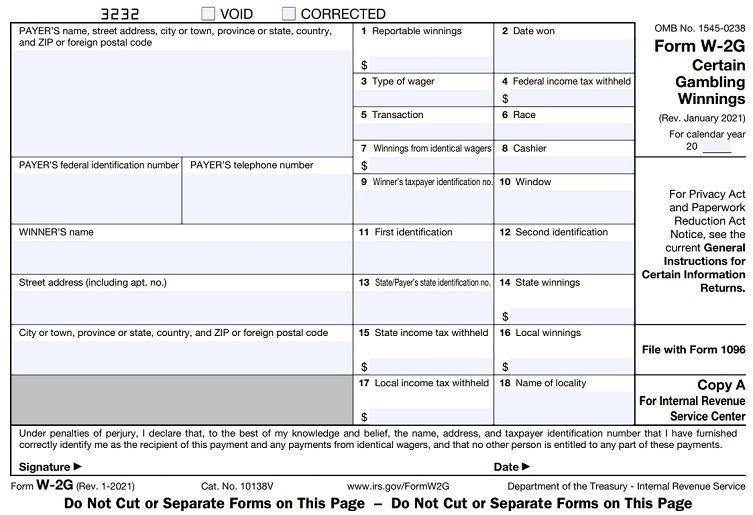

Form W-2G

You have to use the W-2G form to declare and report winnings from gambling:

- How you fill out the form and report it will depend on the type of gambling you’ve been engaged in, the amount you’ve won, and the ratio of winnings per wager.

- This form has to arrive by the end of January each year and be filled out correctly.

- The casino, venue, or business that withheld your tax and reported it to the IRS will send you the forms.

Ordinarily, the W-2G is used for withheld winnings (where a casino reports your wins).

Other Forms

The other form you need to consider is Schedule 1 (Form 1040). This relates to additional income and adjustments to your income. This is where you would declare any prize money, gambling winnings, etc., that has not been withheld by a casino, lottery, or provider. You can also use this form to deduct expenses, such as losses from bets.

Reporting Taxable Winnings & Losses

It is a lot simpler if you don’t deduct your losses. This way, you won’t have to go through half the trouble and won’t need to keep crystal clear records. However, another alternative is to seek out a tax accountant. If you hand them your details, they can adequately break down what you need to report as taxable winnings and what you can deduct as losses.

Deducting Received Losses

Deducting losses is only possible up to the amount you have won. Moreover, you will need to keep clear records of every wager made, everything you’ve won, and back that up with statements and payslips. If you try to deduct losses you haven’t had or can’t prove, you may be audited and, in the worst-case scenario, charged with tax fraud.

Taxes for Professional Gamblers

Professional gamblers in the USA have to use an alternative form. Many online casinos report winnings to the IRS in the USA, so professional bettors will usually already have their taxable winnings withheld. They require Schedule C, where they can deduct their losses from their profits. Moreover, professional gamblers (unlike regular bettors) run their operations as a business, so that they can write off losses to a certain degree.

How to Calculate Winnings & Taxes

Ordinarily, we would recommend seeking a tax accountant to sort out your calculations, as this can get messy. There are also calculators that you can use online to work out what you owe and what you need to declare.

Generally, the first rule is to report whatever you win, even if the casino hasn’t declared it or withheld it for you. Secondly, you cannot subtract your losses from your winnings.

You can’t deduct a $20 stake from a $500 win. A $500 win is reported as $500, not $480.

However, you can itemize the $20 stake as a deduction. It is, of course, up to the IRS to decide whether to reduce that from the total amount of tax you owe.

Tips on How to Reduce Taxes with Personal Plans

To get a reduction on anything gambling tax related, you need to keep immaculate records. This means records on entry tickets, fees, wagers made, prizes won, statements, and payment slips. This is essential if you wish to itemize your deductions and deduct any losses you’ve incurred when gambling. Deducting your losses is a great way of reducing your taxes, but you need to be thorough.

When attempting to deduct your losses or cut your tax down in other ways, we strongly suggest the use of an accountant. They will know all the ins and outs of avoiding paying too much tax or failing to claim back what you can legitimately and legally apply for. Tax lawyers are costly, but they are there for a reason.